I. Introduction

This article discusses the concepts of Absolute Risk and Relative Risk and how they relate to lawsuits. The purpose of this article is to show one way the insurance industry uses faulty logic to deny claims of injured people.

A. Absolute Risk

Absolute risk is a risk stated without any context. If you are a non-smoker, you have a 1% chance off getting cancer.

Non-smoker risk of getting cancer: 1:100

If you are a smoker, you have about a 20% chance of getting cancer.

Smoker risk of getting cancer: 20:100

This means that if you took a random sample of non-smokers, about 1 in every 100 would get cancer at some point.

If you took a random sample of smokers, about 20 in every 100 would get cancer.

Let’s look at a hypothetical. Scarlet, a non-smoker, is considering taking up smoking. She wants to know how much more likely she will be to get cancer if she takes up this new habit. In order to answer her question, we need to turn to relative risk.

B. Relative Risk

Unlike absolute risk, “relative risk” is a comparison between different risk levels. Relative risk compares the risk levels between two groups or between two choices.

Using our example above, let’s return to Scarlet. We already know that 1% of non-smokers get cancer and 20% of smokers get cancer.

If you were unfamiliar with relative risk, you might try to figure out this question with the equation below:

20% – 1% = 19% – WRONG

So does Scarlet increase her chances of getting cancer by 19% by becoming a smoker? NO!

If Scarlet becomes a smoker, her chance of getting cancer doesn’t go up 19%, it goes up 19 TIMES!

To illustrate the difference between 19% and 19 times, it helps to think about it in pies. Assume you have one pie. On top is what you get if you increase your pies by 19%. On the bottom is what you get if you increase your pies by 19 times.

1 pie + 19% of a pie

1 pie + 19 more pies.

1 pie + 19 more pies.

In order to answer our question, we have to use relative risk. Relative Risk is a ratio of one risk to another. This is why Relative Risk is also sometimes called Risk Ratio. It our example we are comparing the risk of getting cancer for a non-smoker to the risk of getting cancer for a smoker.

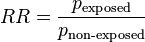

The formula for Relative Risk (RR) is:

In our example it calculates as follows:

(20/100) / (1/100) = 20

So Scarlet will be 20 times or 2,000% more likely to get cancer is she takes up smoking. Yikes!

II. Relative Risk In Lawsuits

A. Introduction

One question that almost always comes up in personal injury lawsuits is: Did this accident cause this injury?

Consider the case of an auto wreck where the plaintiff has a history of a degenerative back. After the accident, her back hurts worse than usual. After going to her doctor and getting an MRI, the doctor finds that she has blown out a a disc in her back.

The plaintiff blames her worsened condition on the wreck – “after the wreck, my back hurt more, it was doing fine before!” The defense blames it on the preexisting condition – “you had a degenerative back, it was going to hurt more anyway!” Who is right? Relative risk can help.

B. The Typical Defense Strategy: Absolute Risk

In a case like this, the typical defense strategy is to hire an expert, either a doctor or a biomechanist who will testify that the likelihood of this type of accident causing this type of injury is statistically low.

For the sake of argument, let’s give it some numbers: Let’s say it was a 10 mph crash. Assume the defense expert will testify as follows: The plaintiff blew out a disc in her back, and 10 mph crashes only do this one in a hundred times.

Defense Argument: 10 mph car accident = 1/100 chance of disc injury. There is a 1% chance this type of accident could cause this type of injury.

We now know that the defense argument only looks at absolute risk which is a poor way to find out if this wreck caused this injury in this plaintiff.

C. The Truth: Relative Risk

As we learned above, absolute risk does not give the whole picture. In order to find out whether this accident caused this injury, we need to look at relative risk.

In order to determine whether this accident caused this injury, we need to compare defendant’s absolute risk to the chance that the plaintiff’s previously asymptomatic disc would happen to become symptomatic on the same day as the auto wreck.

To do this, plaintiff will need expert epidemiological data. Let’s say plaintiff hires an expert who can look at medical databases for people of the same age and gender as the plaintiff. Based on this data, plaintiff’s expert can testify that that there is a 1:1,000 chance that a disc would spontaneously herniate for someone of plaintiff’s age and gender.

Chance for 40 year old woman with history of disc degeneration to have a spontaneous herniation: 1:1,000

Next we need to look at what are the chances that it would herniate on the particular day of the year when the car wreck happened.

1,000 x 365 days in a year = 365,000

So our chances of the disc spontaneously herniating on this particular day are 1:365,000. Now let’s compare that to defense’s absolute risk of 1:1,000.

RR = (1/365,000) / (1/1,000) = 365 to 1 chance that this accident caused this injury.

That is a greater than 99% likelihood that this accident caused this injury. So while there may only be a 1% chance that a 10 mph collision will herniate anyone’s disc, there is a 99% chance that plaintiff’s collision herniated plaintiff’s disc.